Read the latest WaveData articles, or search through our archive.

Follow us on LinkedIn to keep up to date with WaveData news, articles, insights and analysis

Please use complete words when searching…

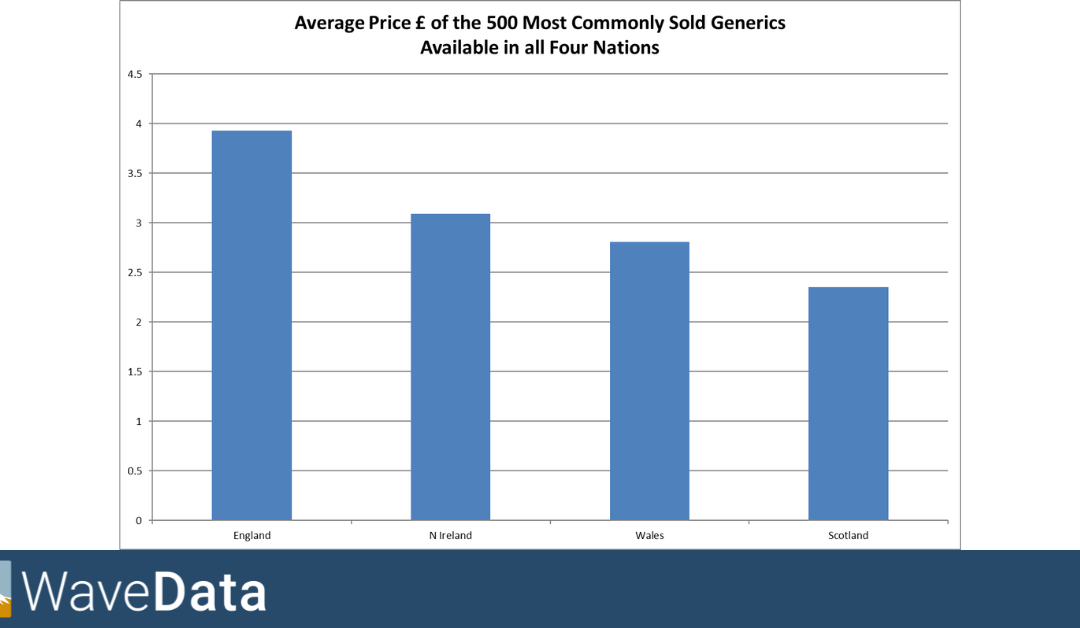

Are generics cheaper in England than the three devolved nations?

WaveData’s MD, Charles Joynson looks at generic products sold in England, Scotland, Northern Ireland, and Wales, in August, September and October of this year, focusing in on the top 500 most commonly advertised products. We only included products whihc were available in all four nations for consistency.

Does competition drive lower prices?

Wavedata looked at the average prices of generic products sold to pharmacies and dispensing doctors between August and October 2023 and compared this with the number of price list offers for the same products in the same time period.

Typical and atypical long term pricing after loss of exclusivity

The first generic versions of Zonisamide Caps 25mg 14 were launched after loss of exclusivity in November 2015. However, in the run-up to this, the prices being offered to pharmacists and dispensing doctors for the brand declined from about £8.00 to about £7.40. This may be because of parallel import competition against the UK brand.

Eplerenone Tabs unstable long term pricing

Eplerenone Tabs were launched in September 2014 after the loss of exclusivity of Pfizer’s Inspra brand. Eplerenone is one of those products which is subject to regular price bounces, concessions and shortages. Each of the two packs has experienced three price bounces and three concessions over the last 10 years.

Are concessions and shortages caused by the DHSC?

It would seem sensible to assume that profitable products are less likely to suffer shortages, concessions and price spikes than products where profit is hard to come by. Charles Joynson, WaveData MD, compared the reimbursement price and the average market price for all the products in the English drug tariff over the last 10 years.

Dispensing Doctor Price Rises

When we compare the average prices paid by pharmacies and Dispensing Doctors for their medical supplies, we see that the pharmacy costs have not risen appreciably, thought dispensing doctor have done exactly the opposite.

What’s the future for my brand post loss of exclusivity (LOE)?

Charles Joynson, WaveData MD, puts a spotlight on Lustral Tabs as we explore the product lifecycle post LOE.

Before generics were launched in November 2005 there was a high degree of similarity between the price of the UK and PI (parallel import) packs of Lustral Tabs 50mg 28. However, as soon as generics were launched the market became much more erratic.

A closer look at Tramadol Caps 50mg 100

With the MAX market price being almost 3 times higher than the MIN market price, we thought we’d take a closer look at Tramadol Caps 50mg 100.

Charles Joynson, WaveData MD, investigates Mebeverine Suspension S/F 50mg/5ml 300ml, DHSC Price Concessions and Pharmacy Profits.

At first we struggled to understand why this product had been added to the list of DHSC Concessions in July. Actually it had the highest concession price at £214.96, but the market price had remained high as had the reimbursement price. However it was only when we began to think about pharmacy profitability that the penny dropped.

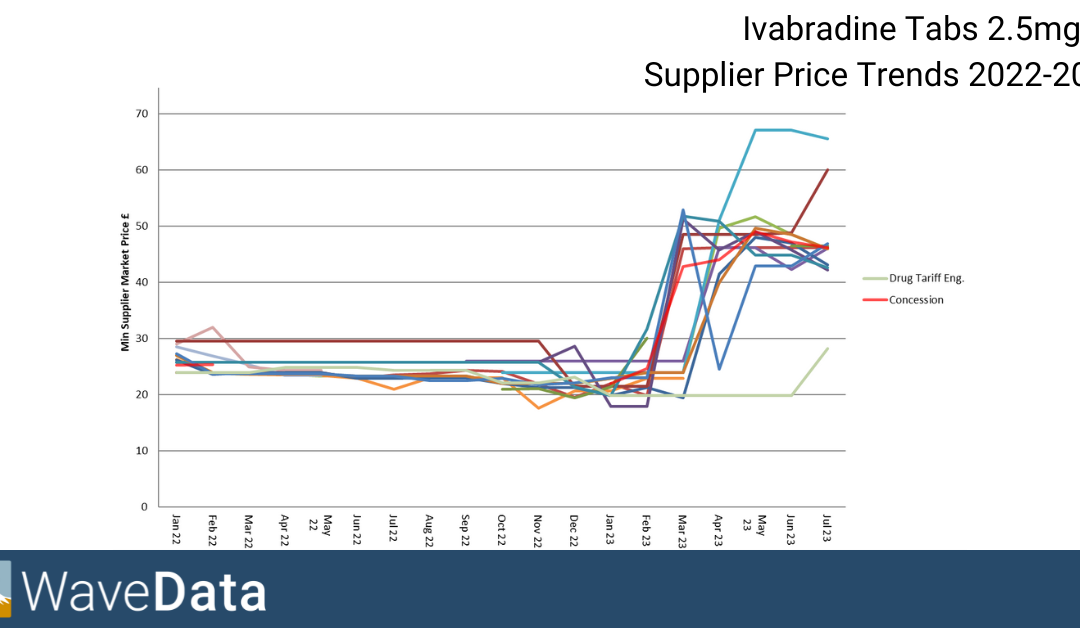

Charles Joynson, WaveData MD, investigates Ivabradine price trends.

In August, this product has had the highest concession price of any of the 76 products with concessions granted. We’ve looked at the trends in the minimum prices by supplier since the beginning of 2022 to see if there is a relationship between the different suppliers and the minimum prices, the English drug tariff and concession prices.

Diagnostic Blood Test Strips. Are they Maintaining Their Pharmacy Prices?

Normally we expect branded devices to maintain their pharmacy purchase prices over long periods of time. However, here this is not the case. Charles Joynson, WaveData MD investigates further. Looking at the long term market price trends of Freestyle Optium Test Strips...

Increases in the prices pharmacists have to pay for Atorvastatin have been much in the news recently. However, are other statins also increasing in price?

Charles Joynson, WaveData MD decided to investigate further.

Firstly all packs of Atorvastatin Tabs have seen price increases in recent weeks except the 60mg 28 and the 30mg 28 packs. It may be that they are used less frequently and the pressure on supply is less intense. The four main 28 Tablet packs of Rosuvastatin have all seen price increases, but Simvastatin and Pravastatin have not.

Long term price cycles in Olanzapine Orodispersible Tablets

This group of schizophrenia medications recently occupied half of the top positions in the Generics Bulletins biggest risers list as discussed by the editor Dave Wallace recently. Looking at the long term there does appear to be a super cycle in place with a period of about 72 months or 5 years between each price spike.

How fast can generic prices recover after a price rise?

It is well known that UK generic prices tend to be lower than those in Europe and that the UK recovers faster after shortages and price rises. Typically this recovery takes months, but here is a case where a product recovered in days. Charles Joynson, WaveData MD, puts a spotlight on Letrozole pricing over the last couple of months.

Morphine Sulphate Solution for Injection Amps 30mg/1ml 10 Long Term UK Market Price Trend

Since Feb 2022 the market price for this Category C product has risen from around £9 to over £20. However, for the eight years prior the prices were stable and the drug tariff remained on or just above the average UK market price. Despite an increase in reimbursement at the end of 2017 there was very little profit to be squeezed from this critical care pain killer.

Long Term UK Market Price Trend of Gentamicin Ear / Eye Drops 0.3% 10ml

Until May 2021 this Category C product had stable pricing and very little profit potential. The average market price between July 2013 and April 2021 was £2.08 and the tariff £2.39, giving pharmacies £0.31, and manufacturers and wholesalers even less. In May 2021 prices rose substantially and since then the average tariff has been £24.10 and the average market price £12.30, leaving a healthy profit of £11.80 for pharmacies and the rest of the supply chain.

Atorvastatin hitting price highs across all strengths in May

With millions of prescriptions each year, ever growing demand and volatile prices statins are almost always on the WaveData Top 10 Generic product search list. In the month of May we saw all strengths of Atorvastatin Tabs 28 Packs feature on the Concessions List, and...

WaveData Case Study – Bespoke Reports: Generics Market Assessment

Client X is launching a new generic product into the UK market, they were looking for data to assess market potential, support their forecasting and feed into the commercial strategy.

Our Customer Success Manager and Data Team worked closely with the Client’s Portfolio Manager and Commercial Manager to ensure we provided the right data for their project needs.

WaveData investigates the ongoing shortage of Naftidrofuryl Caps 100mg 84

Since Jan 2021 Naftidrofuryl Caps 100mg 84 has been granted concessions in 25 out of 29 months…….

WaveData Analysis | Long Term Pricing Trends | Aripiprazole Tabs 5mg 28

This product was launched in December 2014 and has had a reasonably stable price there after. The average price came down very quickly, reaching stability by mid 2016. However, since then this product has experienced a couple of price bounces where the average price rose unexpectedly, concessions had to be granted and increases in the drug tariff followed. Monitoring the price and setting a low watch point could help us identify a future bounce.

Follow us: