Read the latest WaveData articles, or search through our archive.

Follow us on LinkedIn to keep up to date with WaveData news, articles, insights and analysis

Please use complete words when searching…

Charles Joynson, WaveData MD looks at the ‘Covid Effect’ on prices of Non-Steroid Anti Inflamatory Drugs.

When people caught Covid in the early months of 2020, they normally reached for symptomatic control using NSAIDs and Paracetamol. They are affordable, widely available over the counter, have a well-established benefit-risk profile and are good at managing fever, body aches, and headache.

At the time there was pressure on supply, but looking back what happened to prices?

Charles Joynson, WaveData MD, analyses Naproxen E/C Tabs long-term pricing.

The curious wave form or cyclicity of the prices of these two products demonstrate the vulnerability the supply chain has to unprofitable low prices. In the period between 2000 and 2007 both products drifted along with low market prices. For the 250 mg pack this meant prices were generally below £3.00 and for the 500 mg prices were below £5.00.

WaveData MD, Charles Joynson, investigates Tadalafil Tabs 2.5mg 28 Long Term Pricing Trends

Tadalafil Tabs were launched in November 2017 in competition with Eli Lilly’s Cialis Tabs. Generic prices post launch were around the £10.00 mark, significantly lower than the Cialis reimbursement price at the time which was £54.99. However, eight months after launch in July 2018 the main generic manufacturer increased its prices from £5.50 to £45.00 per pack.

Charles Joynson, WaveData MD, investigates Quetiapine Tabs 100mg 60 Long Term Price Trends

Over the last ten years Quetiapine Tabs 100mg 60 has had 4 sets of concessions, making it a risky product to make and distribute. WaveData wanted to find the ‘trigger’ prices which forced manufacturers out of the market due to unprofitability.

WaveData MD, Charles Joynson takes a closer look at Clarithromycin Suspension 250mg/5ml 70ml Concessions and Shortages.

This suspension is one that has been hovering on the edge of unprofitability for a long time and has seen more concessions granted (32) in 2023 – 2024 that any other generic.

Travoprost + Timolol Eye Drops 40mcg/5mg/ml 2.5ml Long Term Price Trends

This product has seen its market price decay from around £13.00 in 2017 – 2020 to a low of £4.29 in September 2024. This may have pushed this combined product, complicated to make due to its combined and device characteristics, into unprofitability as it has been granted concessions in 2022, 2023 and 2024.

Is the number of concessions granted each month increasing or declining?

With the number of concessions granted by DHSC in October at just 106, the lowest number since May 2022, we wondered if this was a signal of a reduction in the number of shortages or if it was just a blip?

Huge price spikes of Apixiban 5mg 56 drive investigation of the long term view of both the generic and brand.

WaveData’s Head of Data, Natalie Fancourt, alerted us to the huge price spikes on Apixaban 5mg 56. Charles Joynson, WaveData MD, decided to investigate the longer term view of both the Generic and Brand.

What Price Triggers A Shortage? Part 3

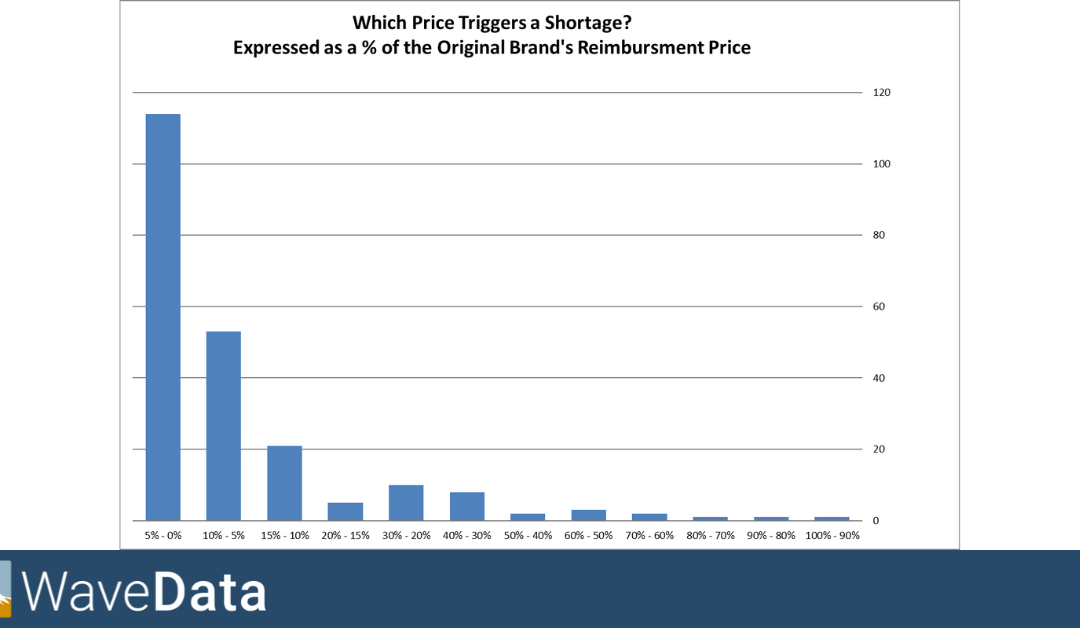

Today we want to explore the low market prices which happen before a shortage begins, and try to work out when manufacturers should alter their forecasts. Looking at the low market prices which precede shortages, it does appear that the vast majority of these take place when the generic product is being sold to pharmacies for between 1% and 7% of the branded products’ reimbursement price.

What Price Triggers a Shortage? Part 2

Today we want to look at these low guaranteed shortage inducing prices for larger groups of products and the first step is to find a way to compare products with widely differing prices. For example, the average market price of Irbesartan Tabs 75mg 28 is less than £1.00, whereas the market price of Famciclovir Tabs 500mg 14 is over £100.00. So, we can’t simply say that any price below £3.00 risks a shortage, because some products are easy and cheap to make and transport, and others more difficult and cost more. To put all products on a level footing we need to find a better way to describe this unprofitable (£1.64) point, so the supply chain can look out for it.

What Price Triggers A Shortage?

Over the last few years, WaveData has repeatedly analysed shortages and concessions, trying to find links with market prices. The connection seems fairly obvious to us, with 24 years of historical market price data we have the luxury of having the right data to be able to analyse long term pricing and concessions side by side. We strongly believe that the primary triggers that cause shortages are based on two key factors.

Is there a link between the number of monthly concessions and the amount of short dated stock on sale to pharmacies and dispensing doctors?

It seems relatively obvious to say that if there is a serious shortage there probably won’t be much stock of any form around, generic, brand, parallel import or short dated. This probably means that any short dated stock that was in the supply chain, even with very little time left before expiry, will be used up very quickly when there’s a major shortage.

How long does it take new generic launches to be added to Category M of the drug tariff?

Twice before WaveData to have looked into this subject only to find there is no link between product value and the delay in the introduction of Category M. However, time moves on, so we thought we’d repeat the analysis, partly because of a recent client request, and...

Pregabalin Prices Hotting Up

Finally, it really does feel like Summer. Looking out of the window at WaveData HQ the sky is blue and the sun is shining. It will be ice creams all round at lunch time today! It’s not just the temperature that's hotting up….. Dave Wallace at The Generics Bulletin...

Olanzapine 10mg 28 – one to watch

Whilst researching for the June edition of WaveData’s Bulletin, Editor Jackie Moss flagged up Olanzapine Tabs 10mg 28 as one to watch. After a reasonably long period of stability, with the average price not exceeding £0.80 since April 2022, we have seen a month on...

How does Category M affect Pharmacies and Manufacturers?

Prompted by a Client’s questions about Category M and the formula that goes behind it to drive Pharmacy profitability, we asked Charles Joynson, WaveData MD, to have a closer look at Category M to see if he can make any sense of it.

Brand reimbursement price increases and the effect on parallel imports

What happens when the department of health (DHSC) agree an increase in the reimbursement price of a brand (VPAS or VPAG)? How does this affect parallel imports?

Why is there a shortage of Clarithromycin?

Dr. Leyla Hannbeck, Chief Executive of the Independent Pharmacies Association, has reported that pharmacies are completely out of stock of Clarithromycin. This antibiotic is used to treat children with whooping cough and pharmacies are now having to turn patients away or ask doctors to prescribe alternative antibiotics.

Today we decided to take a look at the price of Ozempic.

The current Ozempic shortage has been driven by the increase in demand as the drug is being used to treat obese patients for long term weight management, in addition to the original group of type 2 diabetes patients.

Do Pharmacies and Dispensing Doctors always get good deals on parallel imports?

The vast majority of discounts available to Pharmacist and Dispensing Doctors are between 0% and 19.9%, with the average at 11%.

Follow us: