Read the latest WaveData articles, or search through our archive.

Follow us on LinkedIn to keep up to date with WaveData news, articles, insights and analysis

Please use complete words when searching…

Branded Generics, VPAS and The Future of the Generics Industry

Branded generics as well as originator brands are included in the VPAS (The Voluntary Scheme for Branded Medicines Pricing and Access) reimbursement scheme. This is agreed by Government, NHS and industry to ensure the consistent and affordable supply of branded medicines to UK patients. VPAS caps spending on branded medicines, but if there is an overspend, the additional amount is collected as a rebate from pharmaceutical companies. This rebate has increased over the last few years starting at 3.74% in 2014 and reaching 15% in 2022. However, the rebate being discussed for 2023 is forecast to be over 30%.

Branded Generics and True Generics

In recent years branded generics, which are branded versions of off-patent medicines other than the originator, have been included in the VPAS Voluntary Scheme for Branded Medicines Pricing. This has meant that the manufacturers of branded generics have had to return a rebate to the NHS. This rebate is expected to rise to between 23% and 30% in 2023, and the BGMA have been very vocal on its potential negative impact. The prices that both generic manufacturers and wholesalers charge their chemist and dispensing doctor customers are often the same for the true generic and its branded generic equivalent. Often price lists include them on the same line with a single price. However, there are differences in the pricing of the two types of products, as a few wholesalers list them separately.

Rasagiline Tabs 1mg 28 Shortages and Price Spikes

Rasagiline Tabs 1mg 28 was launched onto the UK market as a new generic in August 2015 and since then has had three periods of shortage, during which prices have risen and concessions have been granted by the DHSC to improve supply and pharmacy profitability. These price spikes are believed to be caused by the market price falling below the level at which manufacturers can make a profit, which results in the cancellation of manufacturing orders and the drying up of available dispensing stock.

Predicting Branded Product Shortages

Wavedata have looked in depth at generic product shortages, but have not so far examined branded product shortages in any depth. Therefore we looked at the ABPI’s serious shortage protocol (SSPS) list published on their website each month and chose the list of products with serious shortages which were not expected to be resolved till the end of October 2022. This list included Ovestin Cream, Oestrogel Pump Pack Gel and Sandrena Gel Sachets. We looked at the average, maximum, minimum and standard deviation for the prices which were offered to or paid by pharmacies or dispensing doctors over the last ten years to see if there was any change in the run up to the shortage.

Is another Gabapentin Caps price spike and shortage about to happen?

Two packs of Gabapentin Capsules are subject to regular price increases which have happened four times over the last 20 years. The period between each has increased each time and the highest price has declined. But is another price spike overdue and when will it occur?

Is there a correlation between the Euro to Pound exchange rate and the average price of parallel imports sold to pharmacies and dispensing doctors?

It seems sensible to assume that parallel imports are affected by the Euro to Pound exchange rate as they are sourced from Europe and sold in the UK. Therefore we looked at the prices we had seen advertised for parallel imports by wholesalers and importers over the last 22 years. Then we compared the exchange rate with the average PI price and with the number of PI offers we had seen in price lists sent to pharmacies and dispensing doctors.

Competition between the suppliers of parallel imports over a ten year period.

Efient was launched in the UK in 2009 and the first parallel imports appeared on the UK market in 2011 after a two year ‘honeymoon’ period. In the graph below each colour represents a UK wholesaler selling parallel imported Efient to UK pharmacies and dispensing doctors.

Parallel Imports and how quickly they appear and disappear

Efient was launched in the UK in 2009. This was followed by a two year honeymoon period, which ended in 2011 when the first parallel imports appeared on the UK retail market.

Efient and Prasugrel Tabs 10mg 28 Long Term Lifecycle Market Activity (Price Lists) Trends

Recently we ran a report (also on https://www.wavedata.co.uk/articles ) which showed the long term prices of Efient and Prasugrel Tabs 10mg 28. Today we thought we’d look at the market activity for the same products over the last 10 years. Market activity or record count is the number of prices we see for a product in our data. It gives an indication of the amount of activity wholesalers and manufacturers are putting into selling these products to their customers.

Efient and Prasugrel Tabs 10mg 28 Long Term Lifecycle Price Trends

Efient Tabs 10mg 28 first appeared in Wavedata’s data, collected from pharmacies and dispensing doctors, in April 2011. Parallel Imports appeared before UK packs, which suggests there was a period during which Efient was sold to pharmacies through linked systems without appearing in price lists. There is normally a two year ‘honeymoon’ period before parallel imports start to threaten UK sales and as Daiichi Sankyo’s media website says that Efient was launched in the UK on the 8th April 2009, a two year honeymoon period sounds about right.

Hydrocortisone Ointment and Super Retail Price Cycles

Boom bust cycles exist for up to 81% of generics as market competition forces prices down to levels which cannot be profitably be sustained by manufacturers, at which some stop manufacturing. This leads to a reduction in the stock available to dispense, followed by a shortage and a price rise. Manufacturers then spot that prices are higher and profitable again, so recommence manufacturing. Prices then start to decline as free enterprise restarts and the whole cycle repeats. These cycles are normally about 3 or 4 years long, but they can be longer on occasion.

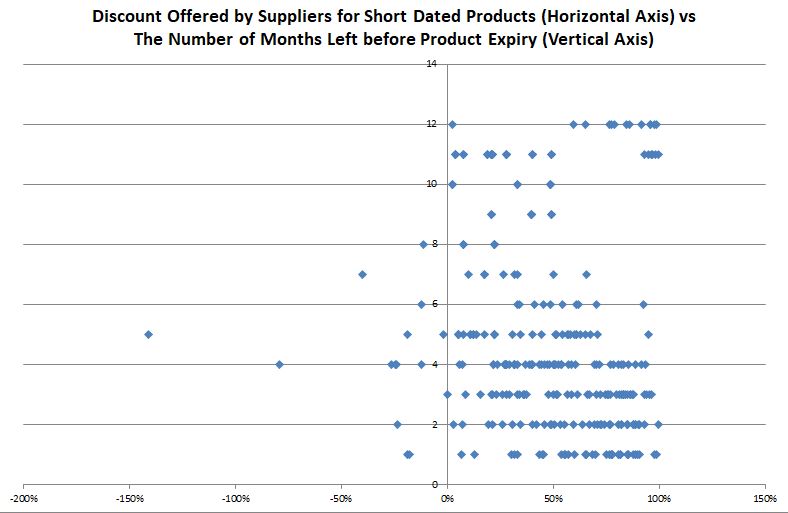

Discount Offered by Suppliers for Short Dated Products vs. The Number of Months Left till Product Expiry

In theory, a product which is due to expire very soon should be offered to pharmacies at a large discount, whereas a product with many months of life remaining should only have a small discount. However, in this analysis and in others we’ve run in the past this is not the case.

What Triggers Generic Price Rises?

When the market price of a generic product declines to a point where manufacturers can no longer make a profit, they may decide to cancel or not commission the next batch of stock. Consequently, the price goes up as the available stock in the market declines.

Generic Product Price Bounces and How Often they Happen

After the originator product loses its exclusivity (LOE) and generics have been launched, the market price of the generic can fall very quickly. Those products with more generic licence holders tend to fall faster than those with fewer. However, where product prices fall very rapidly, licence holders can see the market price fall below a point at which they can make a profit and they may decide not to make any more. At this point the remaining stock in the market becomes more valuable as the amount available to supply pharmacies declines. The result of this is an increase in the price as the few boxes left in wholesaler warehouses increase in value.

Generic Product Price Bounces and How they Happen

After the originator product loses its exclusivity (LOE) and generics have been launched, the market price of the generic can fall very quickly. Those products with more generic licence holders tend to fall faster than those with fewer. However, where product prices fall very rapidly, licence holders can see the market rate fall below a point at which they can make a profit. At this point the remaining stock in the market becomes more valuable as the amount available to supply pharmacies declines.

Generic Product Price Bounces

Price bounces happen after the originator product (Migard Tabs 2.5mg 6 in this case) loses its exclusivity (LOE) and generics have been launched. The market price of the generic can fall very quickly if there are lots of generic licence holders. However, where product prices fall very rapidly, licence holders can see the market rate fall below a point at which they can make a profit. At this point the remaining stock in the market becomes more valuable as the amount available to supply pharmacies declines.

Post Loss of Exclusivity (LOE) and Generic Launch Price Forecasting (Galvus and Vildagliptin)

Generic versions of Galvus are due to be launched by generic manufacturers in the coming weeks, so what is the future for Vildagliptin? There is a ‘honeymoon’ period after generics are launched during which the original brand manufacturer can profitably equalise their price against generics so that branded packs are dispensed against generic prescriptions. This period can be long or short depending on the number of generics which are launched in competition with each other.

Post Launch Price Decline for Generic Tabs and Caps

We tend to assume that different forms of generic solid dose products are equally cheap to produce and so will see their prices decline equally fast after launch. But is this true? To find out Wavedata Looked at 70 capsule products (SKUs) and 343 tablets, tracked their average UK sales prices to pharmacies and dispensing doctors in the months after launch. We then used this to create an estimate of how quickly competition between suppliers forced prices down.

Boom and Bust for Duloxetine E/C Caps and a Forecasting Opportunity

Four packs of Duloxetine E/C Caps have shown repeating cycles of shortages, price variation sand concessions. These sorts of cycles are seen in about 80% of generic products, and can result in severe shortages which affect patients, pharmacies, clinicians and tax payers. We believe that these cycles are predictable and the low prices which trigger shortages can be anticipated.

Originator Brand vs. Branded Generic Entries in Price Lists sent to Pharmacies and Dispensing Doctors

In light of the increases to the rebates that branded and brand-generic manufacturers have to return to the NHS under the VPAS voluntary and statutory schemes, with forecast rebates of 25% in 2023 we thought it worth having a look at the amount of effort each type of manufacturer puts in to advertising its products to pharmacies and dispensing doctors in price lists.

Follow us: